What the New EU VAT MOSS Legislation Means for Bloggers and How to Manage It Effectively

Editor’s note: This post was written by Jawad Khan, a content marketing consultant and a freelance blogger for hire. Follow him on his blog Writing My Destiny, Twitter and Google+.

You’ve always wanted to live the internet lifestyle and build a steady stream of online income. Every successful blogger you’ve read recommends creating your own products and focusing on building an online business instead of just being a freelancer.

But unfortunately, the law makers in the European Union have just made digital product selling much more difficult. If you are selling digital products from your website and have customers from the EU then you need to be aware of the tax rule changes in the EU and how they will impact you.

Simply put, without going into the dry legal stuff, the EU have decided to impose a value added tax, effective from 01 January 2015, on all digital products sold to customers within the EU region. The tax payable will be calculated based on the customer’s location (NOT the seller).

Sounds crazy? Keep reading.

So if you’re a successful blogger, who has worked his pants off over the last few years building a loyal audience, and are finally living the passive income lifestyle by selling eBooks, online course, video tutorials or any other forms of digital products, the EU thinks you’ve had it too easy.

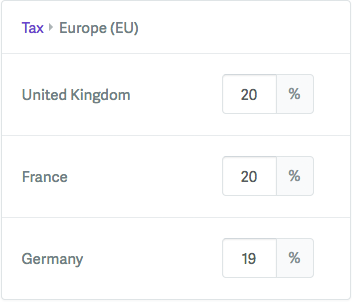

Now when a person in Germany, or any other EU country, purchases an eBook from your blog, YOU will need to pay an additional tax that will be calculated based on the customer’s location (28 EU member states, 75 tax rates). Even if you’re based outside the EU. Because, again, the tax will be calculated on the basis of the buyer’s location, NOT the seller.

You can either register for VAT in each of the 28 EU countries to submit your returns separately, or you could register with one of the “Mini One Stop Shop” (called VAT MOSS) set up in some of the EU states. The most convenient is probably in the UK or Ireland. This would then distribute your taxes to the respective EU member state.

This is dry stuff, I know!

But it’s important to understand the potential repercussions of this new law on your online income. I’m summarizing the information based on my understanding as a freelance writer, please don’t take this as any sort of legal or tax advice.

The new EU VAT rules apply to any digital service delivered via an automated process over the internet that involves only minimal human intervention. Which means there is some good news if you’re providing one on one coaching. Because one on one coaching requires more than minimal human intervention, so it is outside of these changes.

You can read about the (even drier) details of EU VAT MOSS and its implication to EU and NON-EU small businesses, here.

What Can You Do About VAT MOSS?

To start off, you can join thousands of other online entrepreneurs who’ve started this petition against this highly controversial law.

If you’re a digital seller in the EU, the waters are even cloudier as there is confusion around the need to register for VAT in order to use VAT MOSS. Some clarification should come out of the meetings with the UK Government shortly. This is a good source of the latest EU VAT news.

But here is one of the problems for all digital sellers based in or outside the EU.

The new EU VAT rules requires you to capture 2 or 3 pieces of data as evidence of your customer’s location during the purchase process. The type of information that is used as proof is billing address, IP address, and location of bank.

Which means that the majority of existing third party software solutions used by digital sellers won’t do this and will need to be updated. So you need to contact your ecommerce software exactly to understand how you can comply with EU VAT MOSS.

Several third party ecommerce solutions have recently announced how they intend to deal with the issue. But there are still a lot that haven’t. For sellers using PayPal buy buttons, the situation remains confusing. PayPal have stated that they can provide the customer’s location through its API, but you need 2 or 3 pieces of data to comply. So I’m not sure that using a PayPal Buy Button would comply.

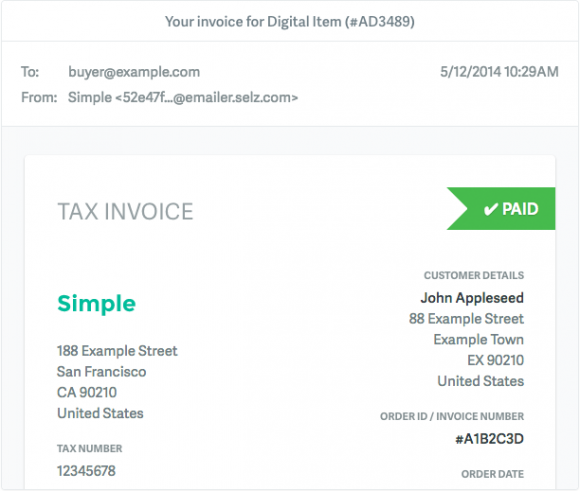

Selz is one ecommerce solution that is actively updating its users about the software updates they’re making to comply with EU VAT MOSS. Selz is releasing a feature that will allow sellers to calculate EU VAT on every sale automatically. It will also detect the buyer’s location based on his IP address and credit card, and report the standard VAT rate applicable in that country.

Future updates will also allow you to set different pricing and tax rules for different countries, and automatically generate personalized invoices for matching customers.

Apart from the software updates, you should also have a good look at your sales statistics. Where do most of your buyers come from? If most of them are from outside the EU then you don’t need to worry too much. But if a significant portion of your sales comes from Greece, France, Germany or any other EU member state (except UK), then you might need to reconsider your sales strategy. You can either stop selling completely to the customers in EU, or you could charge a higher price to customers in that region.

Important: Do not consider this post as legal advice. My only intention is to alert you about the EU VAT changes that will be in effect from 01 Jan 2015. You should seek professional legal advice on this, especially if you’re based in the EU.

Conclusion

Digital sellers from countries outside the EU are also affected by this rule change. To comply with the law change from 1 Jan 2015 you should immediately check whether your ecommerce tools will verify the buyer’s location and capture the required VAT sales data. You only have a few weeks to change systems if you need to. For digital sellers in the EU it is potentially even more disruptive with the confusion around VAT registration. Hopefully, with the growing outrage among online sellers, the EU law makers will be forced to rethink this insane law and come up with a sensible practical implementation. Although, I am not holding my breath.