LinkedIn Goes Public But Who Owns The Biggest Slice Of The Pie?

LinkedIn is proving it pays to network. The company has filled its S-1 papers with the Security and Exchanges Comission for an initial public offering.

LinkedIn is proving it pays to network. The company has filled its S-1 papers with the Security and Exchanges Comission for an initial public offering.

2010 was the year of IPOs, or at least guessing which Internet giants would hit Wallstreet first. Facebook, Demand Media and Skype were the biggest names tossed around the business networking site LinkedIn is starting 2011 as a publicly traded company.

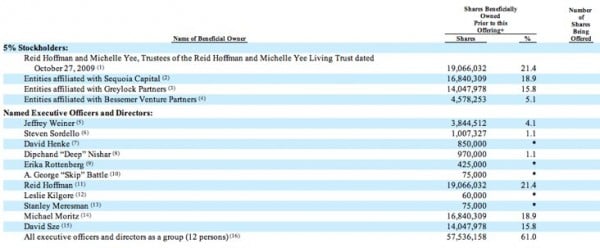

But who owns what of LinkedIn? Previously unreleased details were revealed in its SEC filing as the company prepares to go public.

Via TechCrunch

TechCrunch sifted through LinkedIn’s S-1’s papers and discovered founder/chairman Reid Hoffman along with his wife Michelle Yee own 19,066,032 shares or a 21.4% share of the company. Other notable shareholders include investors Sequoia Capital, Greylock Partners and Bessemer Venture Partners which own 18.9, 15.8 and 5.1 percent of shares respectively. Until the share prices are announced, we won’t know exactly how big the impact of say, 19 million shares is but in the mean time we can guesstimate.

Nicholas Carson at Business Insider did some math and came to this conclusion:

But we do know the company has ~$200 million annual revenues. That’s up 200% from a year ago, so a healthy 10X valuation is entirely called for. So figure it’s a $2 billion company, pre-IPO.

That would mean LinkedIn Reid Hoffman’s 21.4% stake is worth $430 million. CEO Jeff Weiner’s is worth $80 million. Sequoia’s stake – bought for $4.7 million – is worth $380 million, Greylock’s $320 million, Bessemer’s, $100 million.

Not bad for a company that makes networking with business professionals easier. If this is LinkedIn’s IPO, what will Facebook’s monstrous IPO look like?