5 Tools to Keep Track of Your Online Writing Business Finances

How did you start out as an online writer? Perhaps you got odd jobs here and there, and you didn’t really see what you were doing as a business. If you’ve been doing this for several years now, your client base has probably expanded, and you might even consider what you do as a small business.

When your online writing activities transform into a legit business, things get better, albeit with some more responsibilities. While you may have more revenue streams, you may have more expenses as well. You might have to tap into savings, consider credit card balance transfers if you have existing credit card problems. According to Jeffrey Weber of SmartBalanceTransfers.com, this is one of the most effective and cost-efficient ways to manage credit card debt and starting anew.

You may even have to learn how to manage your own books. You can always take on the services of an accountant, but that will only add to your expenses.

If you need a little help tracking your online writing business finances – expenses and earnings both – here are some tools which can make things easier for you without having to outsource this aspect of the business.

1. Google Spreadsheet

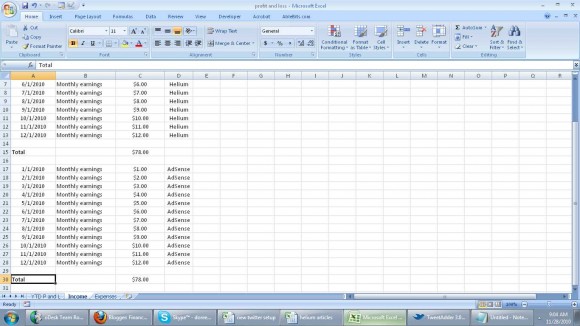

By far the simplest and easiest way to keep track of income and expenses is to create a spreadsheet. You probably already have a Google account, so you only have to access your Google Drive and create a spreadsheet which you can use to monitor your online business finances.

Above is a simple example of what you can do: just create tabs for earnings and expenses, indicate the client/source and expense item, as well as the amount. With spreadsheets, you can use formulas so that amounts are automatically added or subtracted as needed.

Note: This tool is the most basic you can use, and for many it works. If you need more features like bank integration, read on.

2. inDinero

inDinero packs a whole lot of features. Not only does it help you with accounting, but it can also serve as a tool for taxes and payroll. Even if you’re the only employee of your business, help with taxes is a big plus already.

The downside is that the service is not free, although they have packages for small business (1-30 employees). Additionally, they don’t just take on clients indiscriminately. That says a lot about how they take care of their customers. You have to request for an invite and see how things work out for you.

Related: How to Make It Through Those Lean Months

3. QuickBooks

QuickBooks is already one of the most popular finance tracking software out there, and it offers more than simply monitoring your earnings and expenses. Just like inDinero, if you have other employees, you can run payroll with QuickBooks. You can even do client invoicing via the platform, making sure you do not forget to do this at the appropriate time. Even more, having a system like this in place helps your professional image.

QuickBooks for Small Business starts at $12.95 per month, but you can try it for free first.

4. Zoho Books

“Smart Accounting for Growing Businesses” is the tagline of Zoho Books, and it also enables you to send invoices, track expenses, as well as connect your bank account for automated transactions.

They have one pricing for all their features, which is a good thing, but you’ll have to shell out $24 per month. That’s still cheaper than keeping an accountant on a retainer basis! And, you can try it for free for 14 days.

5. FreshBooks

If you have no accounting background at all, and you feel that you can use all the help you can get, then FreshBooks is a good option. It is made for non-accountants so that you can easily send invoices, while at the same time keep track of your online writing business finances without having to worry about missing a single detail. They offer a trial of 30 days, which is perfect so that you can see how it works for you for a month. The cheapest package, Seedling, costs $19.95 per month and limits you to 25 clients.